Objective:

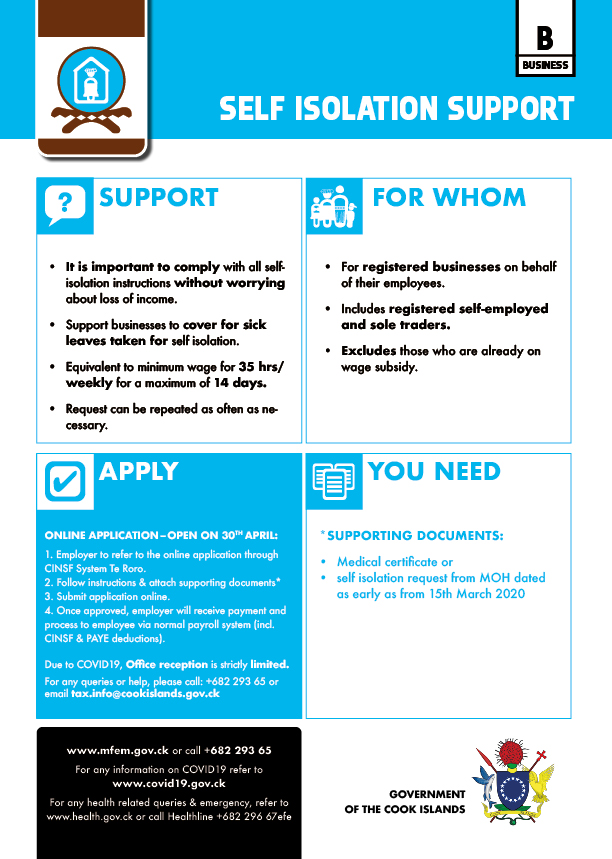

To support businesses covering staff absences due to self-isolation requirements and who are not under the wage subsidy scheme. In prevention of a pandemic outbreak, it is important to encourage everyone to respect and comply to all self-isolation instructions without worrying about loss of income.

The self-isolation support will not impact an employee’s accumulated leave entitlement. It is a separate category of emergency leave entitlement offered under the COVID19 stimulus package for a maximum period of 14 days at a time, at the minimum wage. It is possible that the same employee may have to self-isolate more than once throughout this pandemic, as such, the support can be requested by the Employer as often as needed.

This support will only cover self-isolation as defined under the public health guidelines, where the employee is:

- not sick, cannot perform work remotely and has been advised by the Ministry of Health to self-isolate;

- not sick but has to care for dependents who are required to self-isolate or who are sick with COVID-19.

- sick with COVID-19.

In cases where the affected employee is not sick and can perform work remotely whilst in mandatory isolation, they will continue to be paid as per their usual rate of pay in agreement with their employer.

Eligibility:

- Registered Employer on behalf of employees requiring self-isolation and/or quarantine.

- Medical certificate from Ministry of Health confirming the need for self-isolation and/or quarantine.

Supporting documents:

- Online application through Employer’s CINSF account on behalf of the affected Employee

- Medical certificate or self isolation request from MOH dated as early as from 15th March 2020

Conditions :

- Businesses can omit declaring any available sick leave and request full amount of the cover. Compliance unit to make spot checks and request copies of available payslips for those employees being covered.

- Determining whether the work can be done remotely for those who are not sick but still requested to self-isolate/quarantine. Compliance unit to determine the criteria to verify that the company is unable to offer remote tasks to the employee to do.

Application process for Employers:

- Employer to refer to the online application through Te Roro. Application open on the 15 April 2020.

- Fill up form as requested and upload supporting documents

- Submit application online.

- Once approved, Employer will received the support and process to Employee via normal payroll system (incl. PAYE and CINSF deductions).

- Office support will be strictly limited. Support available on 29365 or email [email protected]