Objective:

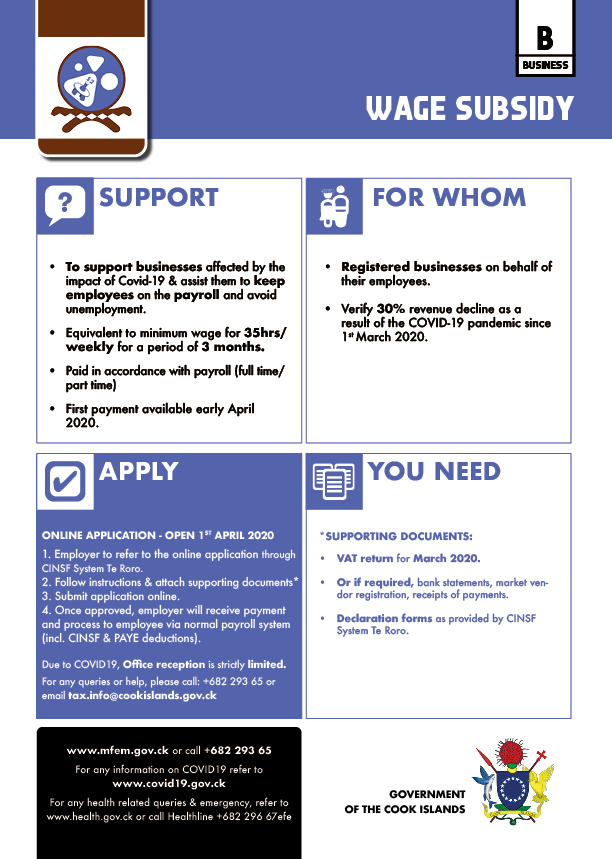

Financial support for businesses affected by the impact of Covid-19 to keep their employees on the payroll and avoid unemployment. Wage subsidy will remain available even in Code Red. Wage subsidy is based on minimum wage for 35hrs/weekly over a period of 3 months:

- $266 per week for a full-time employee working 20 hours per week or more;

- $133 per week for a part-time employee working between 5 and 19 hours per week.

The employer has an obligation to declare the number of employees on the payroll and their hours of work. In case of termination of any employees, the wage subsidy claim must be adjusted or the employer will be liable to repay back any overpayment.

The wage subsidy will only cover employees who are currently on the payroll and in the Cook Islands.

Eligibility:

- Businesses registered with RMD and CINSF

- Verified 30% revenue decline as a result of the COVID-19 pandemic since 1 March 2020.

Application process:

- Employer to refer to the online application through Te Roro. Application open on the 1 April 2020.

- Submit application online.

- Once approved, Employer will received the support and process to Employee via normal payroll system (incl. PAYE and CINSF deductions).

- Employer to submit a declaration of wage subsidy through their CINSF account before the next monthly payment.

- Office reception will be strictly limited. Support available by phone 293 65 or by email [email protected]

Conditions:

- Based on Minimum wage of $7.60 for 35hrs weekly, prorated to the number of hours worked by each Employee as declared by the Employer.

- 30% Revenue decline must be verified by VAT return before the payment is released (comparison with last year).

- Businesses must be registered with CINSF and RMD. If not registered, they have to register by 30th April and provide evidence that they have been in operation prior to 1 March 2020.

- If the business is not VAT registered or have been in business for less than 3 months prior to 1 March, documentation like bank statements, market registration etc need to be submitted to enable assessment of loss of income.

- Wage subsidy will not be made available to those contract workers who are currently unable to return from overseas. Individual consideration can be done once the worker is back into the country at a later stage.