Download Application Form

English

Cook Islands Maori

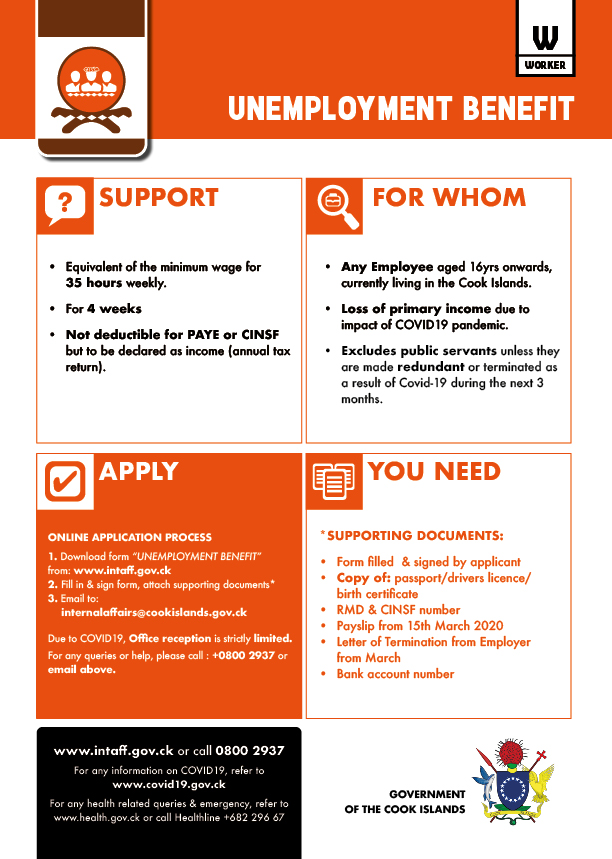

Objective:

To provide financial support to any employee currently in the Cook Islands who have lost their employment as a result of the COVID-19 pandemic. The unemployment benefit is the equivalent of the minimum wage for 35 hours weekly over 4 weeks ( $1064). As a benefit, it will not be subjected to PAYE and CINSF deductions but will need to be declared as income through the annual tax return process.

All applicants under the unemployment benefit will automatically be directed to the Employment Services to receive support in finding new employment. Should this fail and at the end of the one-month allocation, the beneficiary will be put onto the Destitute Allowance ( $50 weekly ).

Eligibility:

- Any individual of working age from 16yrs onwards (exclude. Students and self employed)

- Loss of primary income

- Excludes public servants unless they are made redundant or terminated as a result of COVID-19 during the next 3 months

Supporting documents:

- Form filled and duly signed by parent

- Valid Identification paper

(passport/drivers licence/birth certificate) - RMD and CINSF number

- Payslip from 15th March 2020

- Letter of Termination from Employer dated within the month of March

- Bank account number and the letter of confirmation from the bank

Application process:

- Fill up and sign form

- Provide supporting documents

- Email all documents to [email protected]

- If no email, drop off hard copy of documents to INTAFF’s Welfare and Employment Support Hub, located at Sinai Hall, Avarua.

- Office reception will be strictly limited.

- Telephone support available on 0800 2937.

Conditions :

- Minimum wage of $7.60 for 35hrs weekly over a single month, i.e $532 per fortnight over one month only per beneficiary.

- Payments to be done on the 1st and 16th of the month covering payment from date of application. It will be possible to backpay from the date of the final pay or at the earliest, backpay to 30th March.

- Any working individual 60yrs and above can receive both their pension benefit and unemployment benefit.

- The unemployment benefit is a blanket payment regardless of the status of employment (fulltime or part time).

- Any self-employed applicant should be redirected to the Wage Subsidy.

- Unemployment benefit is a one time access.

- If a beneficiary fails to find employment after the one month, they can be redirected to the Destitute Allowance.

- Unemployment benefit are not taxed or deducted for CINSF, however it needs to be declared through the annual tax return process