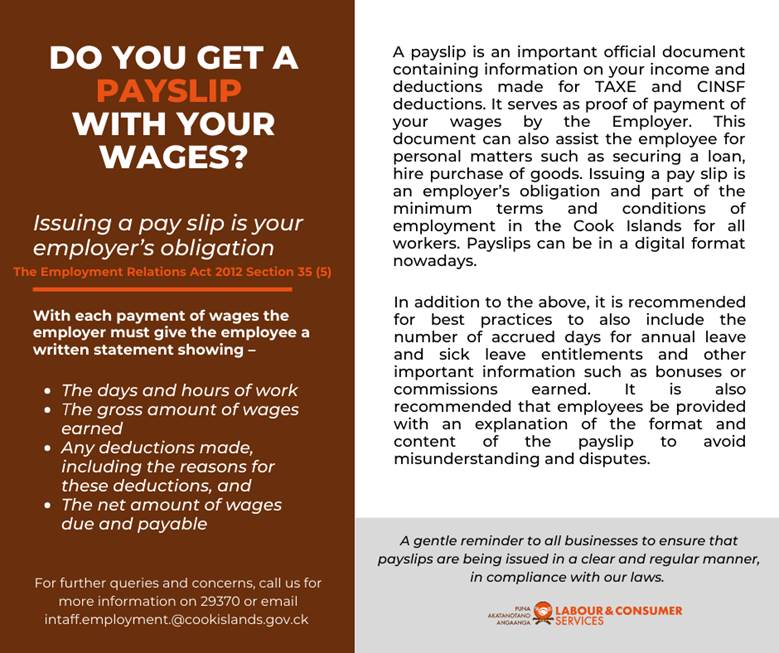

A payslip is an important official document containing information on your income and deductions made for TAXE and CINSF deductions. It serves as proof of payment of your wages by the Employer. This document can also assist the employee for personal matters such as securing a loan, hire the purchase of goods. Issuing a pay slip is an employer’s obligation and part of the minimum terms and conditions of employment in the Cook Islands for all workers and should be issued inline with the day the wages is paid or before. Payslips can be in a digital format nowadays.

The Employment Relations Act 2012 Section 35 (5) says

With each payment of wages the employer must give the employee a written statement showing –

o The days and hours of work

o The gross amount of wages earned

o Any deductions made, including the reasons for these deductions, and

o The net amount of wages due and payable

In addition to the above, it is recommended for best practices to also include the number of accrued days for annual leave and sick leave entitlements and other important information such as bonuses or commissions earned. It is also recommended that employees be provided with an explanation of the format and content of the payslip to avoid misunderstanding and disputes.

A gentle reminder to all businesses to ensure that payslips are being issued in a clear and regular manner, in compliance with our laws. For further queries and concerns, call us for more information on 29370 or email [email protected]